Our business debit/credit cards serve as financial tools aimed at streamlining and effectively managing business expenses. Features and benefits typically associated with these cards;

- Expense Management: Business debit/credit cards help separate personal and business expenses, making it easier to track and manage company spending. This separation simplifies accounting and tax reporting processes.

- Convenience: These cards offer businesses the convenience of making purchases, paying bills, and accessing cash quickly and securely. They can be used globally, facilitating transactions both domestically and internationally.

- Customizable Limits: We offer customizable spending limits for business debit/credit cards, allowing businesses to control employee spending based on their roles and responsibilities.

- Reward Programs: Some business cards may offer rewards or cashback incentives for certain types of purchases, providing additional value to businesses for their spending.

- Expense Tracking Tools: Many business debit/credit card accounts come with online banking platforms or mobile apps that offer expense tracking tools. These tools can categorize expenses, generate spending reports, and provide insights into company spending patterns.

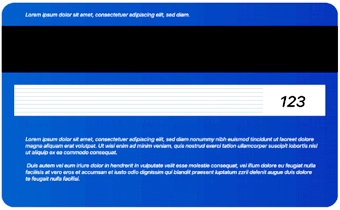

- Fraud Protection: We provide robust security features, such as EMV chip technology, encryption, and fraud monitoring, to protect against unauthorized transactions and identity theft.

- Integration with Accounting Software: Some business card programs offer integration with popular accounting software platforms, allowing for seamless synchronization of transaction data and simplifying reconciliation processes.

- Employee Cards: For businesses with multiple employees, these cards often come with the option to issue supplementary cards to authorized employees. This enables businesses to delegate purchasing authority while maintaining control over spending.

- Travel Benefits: Depending on the card program, businesses may also access travel-related benefits such as travel insurance, rental car insurance, and airport lounge access.